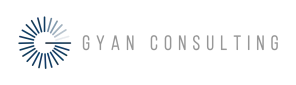

Artificial intelligence in banking is no longer the future it’s today’s reality reshaping finance worldwide. Technology in the banking sector has never ceased to influence the industry, starting with the advent of the ATM machine, online banking, and mobile applications. Artificial intelligence (AI) is now becoming the next source of change. AI is transforming the way banks operate, deliver services to their customers, and remain competitive due to its capacity to handle large volumes of data, learn through patterns, and automate its decisions.

According to McKinsey, AI will bring more than 1 trillion of new value to the global banking industry in a year, as of 2030. It is not a technological change, but a business revolution. Those banks who adopt AI will become quicker, smarter, and customer-centric, whereas those that do not will face the risk of being left behind. The victors will be those, which will combine advanced AI with transparent plans and confidence of the customer.

Smarter Customer Experiences with AI

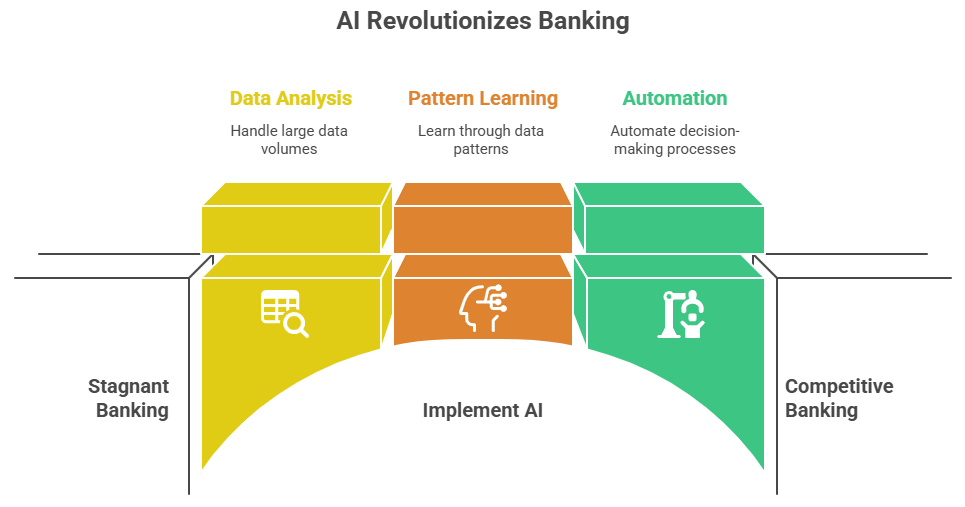

The expectations of the customers have evolved. The modern banking consumers desire immediate response, customized service and flawless online services. Chatbots that use AI, such as the one created by the Bank of America called Erica, have already dealt with more than 1.5 billion interactions. These tools are transforming the concept of service and setting new standards of customer interaction through speed and customization.

Such tools do not only respond to queries, they give one financial information, reminders, and customized advice. The result? The customers will feel supported 24/7, and the banks will save operational costs. To most institutions, AI experiences can be the key to greater satisfaction and loyalty. This smooth support over time makes the banks reliable companions in the financial experiences of the customers as opposed to service providers.

Read Our Blog:- 7 Must Have Tools for iOS App Development in 2025

AI in Risk Management and Fraud Detection in Banking

Banks lose billions of money every year to fraudulent transactions. To counterattack, AI is used to assess patterns in real time and identify suspicious activity before it can do any harm. The AIs used in JPMorgan Chase, such as billions of transactions per day, detect anomalies in a few seconds, which humans could take weeks to identify. Such speed and accuracy make AI a mandatory firewall against the emerging financial crimes.

It is because AI development services are essential due to this capacity to learn historical patterns of fraud and adjust to emerging threats. As the cost of cybercrime is estimated to hit up to 10.5 trillion every year in 2025, the role of AI in risk management of the banking sector will continue to grow. AI prevents customer losses and inspires customer trust in online banking services by actively identifying anomalies.

Read Our Blog:- From Concept to Conversion: How iOS Apps Can Elevate Your Business

Automating Core Banking Operations

In the background, banks waste a lot of time and resources doing repetitive activities such as checking documents, reporting and approving loans. These processes are being automated by AI, commonly known as Robotic Process Automation (RPA). RPA helps to reduce costs as well as liberate employees to concentrate on more valuable tasks that drive customer service and innovation.

Consider the JPMorgan platform, COIN, which analyzes loan agreements in seconds, which used to take 360,000 human hours a year. Such automation costs less, and it also enables the employees to concentrate on high-value work, enhancing efficiency in all aspects. It is a vivid illustration of the extent to which AI-driven automation can be applied to massive tasks and ensure high accuracy and compliance.

Read Our Blog:- Why Startups Should Prioritize Android App Development Before iOS

AI-Powered Financial Advisory and Wealth Management

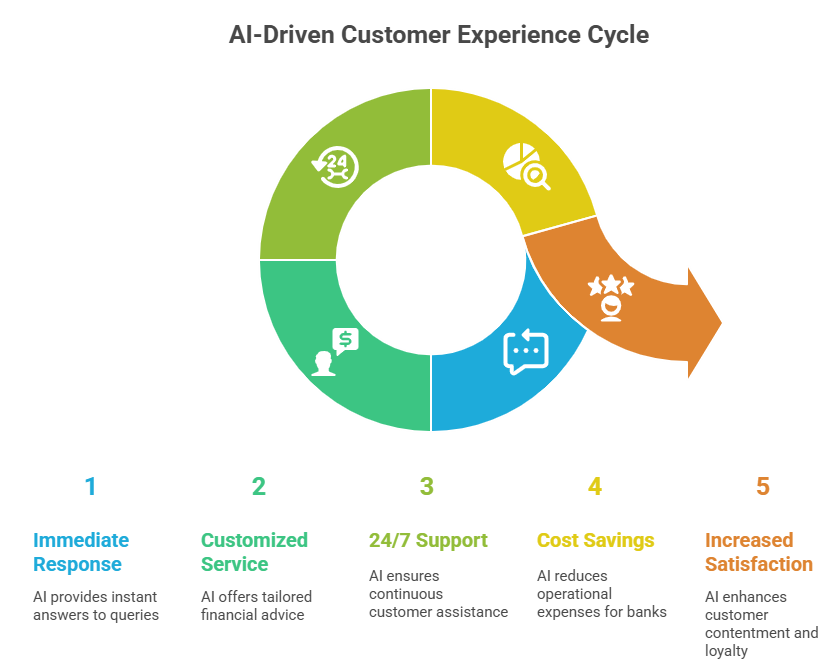

Financial advice was traditionally accessible only to wealthy people. AI is transforming it by making advisory services more accessible and cheaper. Robo-advisors, such as Betterment and Wealthfront, apply AI algorithms to develop individual investment portfolios of millions of customers. The democratization of wealth management is enabling both ordinary investors to make smart financial choices with a sense of security.

In the case of banks, it implies that they can grow advisory services without employing more people. It is estimated that by 2025, robo-advisors will control more than $1.4 trillion of assets worldwide, providing customers with tailored, data-driven advice and increasing the capacity of banks to target more clients. With an increasing adoption process, AI-based advisory platforms will become part of the current banking, combining efficiency with inclusiveness.

Regulatory Compliance and Transparency Through AI

The financial sector is a highly regulated one and lack of compliance may lead to huge fines. Banks are using AI solutions to remain in compliance with their transactions, report analysis, and policy review to meet international banking standards such as GDPR and Basel III. This proactive compliance does not only decrease the risk of the law, but also enhances the credibility of the institutions and the trust of the customers.

The AI also increases transparency as it automatically produces audit trails. Deloitte said that financial institutions that are using AI in compliance also save 30-40 percent of money and also reduce the chances of human error. This is what allows AI to be not a mere compliance tool anymore, but rather a strategic advantage. Intelligent workflows allow banks to be ahead of the regulations and create a stronger trust among customers and regulators.

Challenges: Ethical, Security, and Workforce Implications

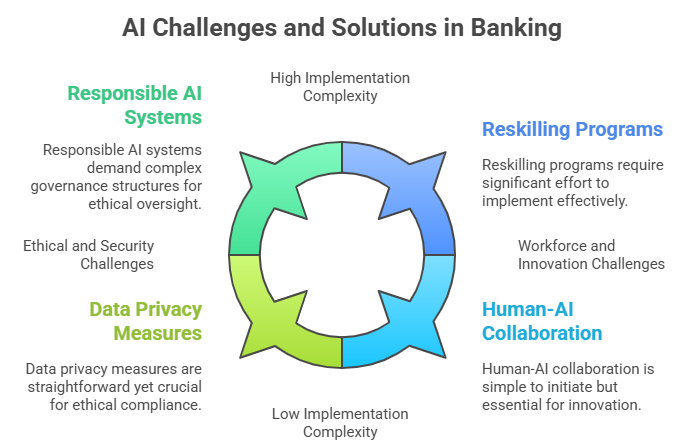

The use of AI has enormous advantages but equally presents challenges too. The issue of algorithmic bias, data privacy, and cybersecurity threats are still major matters. A poorly made AI decision in loan applications, say, can be detrimental to the customers and reputation of a bank. The transparency and robust governance of AI systems in banking is a key solution to these threats, which can be implemented through the introduction of responsible AI systems.

There’s also the human factor. With the increasing automation of banks, employees should be reskilled to collaborate with the AI and emphasize on complex problem-solving and customer relationships. A balance between efficiency and ethics will also be very essential when adopting AI in a sustainable manner. Finally, the future of banking will rely on the ability to combine human expertise and AI-driven insights, which will allow providing innovation and trust.

The Road Ahead: AI and the Future of Finance

AI will become the powerhouse in the financial sphere, yet technology will not be enough to achieve success: it will require a strategy and trust. Banks which will be able to incorporate AI thoughtfully without losing human touch in service will be at a competitive advantage. Indeed, these will not just innovate, but also introduce new norms of ethical customer-oriented banking within the digital age.

Predictive analytics to offer tailor-made deals, artificial intelligence to operate blockchain and transact safely and securely, the prospects are limitless. In the years to come, AI will become as ubiquitous in the banking sector as mobile applications are in the present, transforming the sector into something smarter, quicker and more agile. Those institutions that start adopting this change sooner will be those that will dominate the financial scene of the future.

Conclusion

The future of banking is artificial intelligence that is redefining and enhancing customer experiences, increasing security, and automating processes. The evidence is obvious: the use of AI contributes to a higher customer retention rate, accelerated decision-making and saved billions of dollars. AI is rapidly emerging as the engine of growth in a sector that is based on trust.

In the case of banks and other financial institutions, the question of whether to go the AI route is no longer an issue of concern, but rather how to do it efficiently. Those who take action today will shape the future of finance and laggards will not be relevant in a marketplace continually driven by agility and innovation.

At Gyan Consulting, we guide businesses to overcome this change. Our team develops scalable, secure and future-proof systems, based on AI-driven chatbots, and enhanced data analytics and compliance solutions. When your organization is willing to adopt AI and be the first in the financial revolution, then we can create the future together.

With a deep passion for technology and enterprise growth, I help organizations embrace AI development, blockchain solutions, and custom software to drive lasting transformation. As Senior Business Development Manager at Gyan Consulting, I combine strategic insight with hands-on industry knowledge, enabling businesses to scale smarter and innovate with confidence. View Profile