All the founders are familiar with the capital-raising process. The conventional fundraising process usually involves several months of pitching to venture capitalists, making equity transactions and overcoming regulatory challenges. In the case of startups at an early stage, time spent raising funds is time wasted in product construction. This has created an opportunity where alternative models such as tokenized fundraising are emerging that offer speed, inclusivity, and a better fit between builders and their communities.

Crypto launchpads have also become a more dynamic solution in the last few years, a faster one. They are transforming the way startups raise capital using blockchain, tokenization, and community-based funding, and are making a marathon a sprint. In addition to acceleration, launchpads are also making access more democratic, so smaller investors can be early entrants and startups gain instant exposure in active crypto communities.

What Are Crypto Launchpads? A New Capital-Raising Model

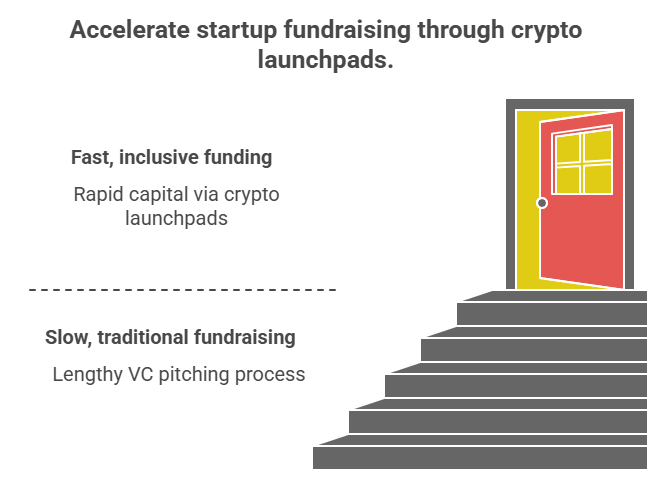

A crypto launchpad is a service that assists startups to raise funds through the direct issuance of tokens to investors. Startups selling utility tokens can leverage cryptocurrency development services to ensure seamless creation and launch. Not only will this model hasten the process of capital formation but will also synchronize community incentives since those who initially supported the project will be active players in the project development and achievement.

In the case of the business, this does not make them restricted to local investors or a lengthy process of negotiation. Launchpad opens global participation avenues and startups are able to access capital much faster than traditional models. This global scope also contributes to the creation of diversified communities when a project is launched since the initial investors become promoters of the brand, not only through funding but also through other forms of support.

Read Our Blog:- The Evolution of NFT Marketplaces: What Businesses Should Know

Why Speed Matters: Traditional Fundraising vs Launchpads

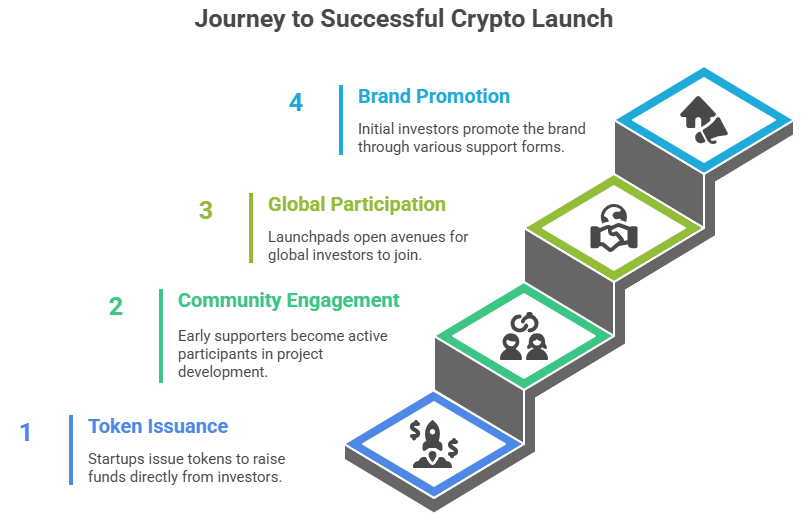

Competitive markets are speed sensitive. Established methods of raising funds can take six months or even a year where market opportunities can run dry. Launchpads squeeze that timeframe down to nothing. Launchpads enable startups to start executing and developing their products at a time when market momentum is most powerful by providing faster access to capital through crypto launchpad development services .

Using Initial DEX Offerings (IDOs) or Initial Game Offerings (IGOs), startups have the potential to raise millions of dollars within weeks (sometimes days). The advantage of speed in the initial stages of development can be seen in the example of blockchain gaming startups, which raised over $1.5 billion dollars collectively in 2022 with the help of launchpads.

Read Our Blog:- 10 Reasons Why Your Business Needs Custom Software Development

The Role of Community in Faster Capital Access

Launchpads are based on community investments as opposed to traditional models where investors are typically few and centralized. The first fans turn into token holders, which gives them both monetary and emotional interest in the start-up success. This common ownership has a strong network effect, as communities not only finance the projects but also actively promote them, test them, and contribute to their development.

This forms strong network effects. The awareness can be enhanced, early adopters can be encouraged, the demand of the token can be high, and the process of raising capital can be even more efficient and quicker with the help of a strong and active community. In the long run, this traction builds and turns first supporters into long-term supporters who contribute to growth far beyond the initial phase of fundraising.

Read Our Blog:- Why Legacy Systems Are Costing Detroit Businesses More Than They Think

Transparency, Security, and Trust in Token-Based Funding

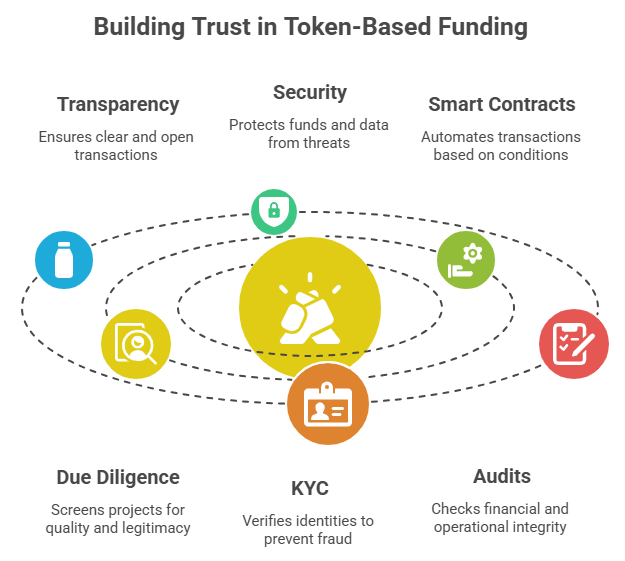

One of the greatest challenges to startups is trust. Investors would desire to know that their funds are safe, particularly in online markets. Launchpads solve this through the use of smart contracts that automate the transactions so that the funds are only distributed when the conditions are fulfilled. Not only does this transparency mitigate risk of fraud, it also creates a long-term credibility that gives founders and investors more faith in the fundraising process.

Most of the major launch pads also screen projects with due diligence, KYC, and audits. The transparency minimizes the risk to investors, and provides the startups with credibility, which then accelerates the process of getting financed, as it reduces barriers to participation. Launchpads filter out low-quality or fraudulent projects, enabling them to provide a safer environment that encourages serious investors and fosters trust throughout the ecosystem.

Case Studies: Startups That Raised Millions Through Launchpads

The stories of success are eloquent. In 2021, the play-to-earn game, Axie Infinity, raised funds by selling tokens that subsequently propelled it to a valuation of more than 3 billion dollars. Likewise, initiatives such as StepN and Polkastarter alumni have shown how launchpads can also offer more than money, such as a launch community.

Launchpads are more than mere fundraising platforms to many startups: they represent a portal to brand visibility, partnerships, and early adopters, and they help a company to grow faster than traditional fundraising. They assist projects in gaining credibility more quickly and developing the strategic relationships that lead to long-term success by providing an in-built exposure to a global crypto community.

Challenges and Risks Businesses Should Understand

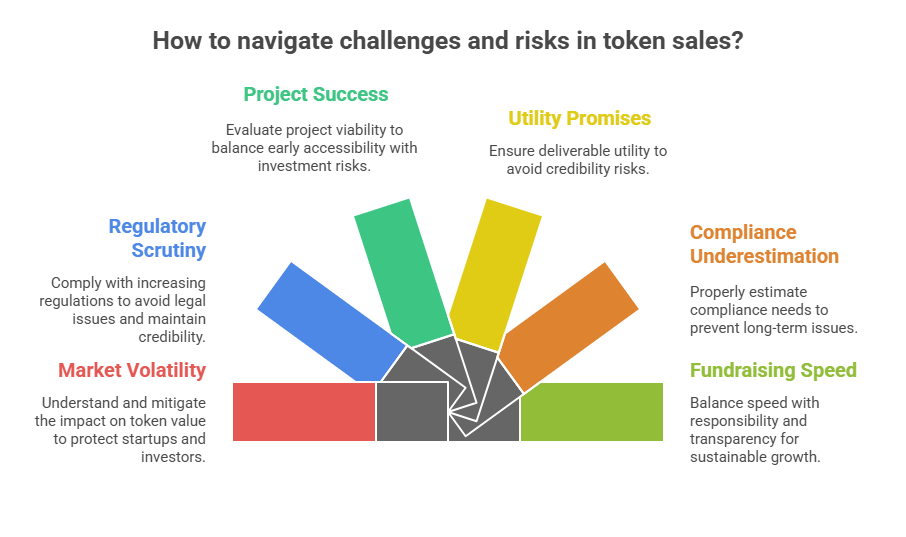

Naturally, there are no risks in launchpads. The volatility of the market may affect the value of the token, which poses a risk to startups and investors. Another difficulty is regulatory scrutiny, with governments in all parts of the world increasing regulation of token sales. Also, not every project that is initiated in such sites is successful, and, thus, the participants need to weigh the benefits of early accessibility against the risks of high-risk investment.

Startup companies should also make sure not to promise utility that they cannot deliver, or to underestimate compliance. A fast fundraising process can bring long-term credibility risks with it unless it is carefully planned. The ones that win in this space are the ones which strike a balance between speed and responsibility and transparency. They established the basis of sustainable growth instead of the hype that comes and goes by matching good governance with creative fundraising.

The Future of Startup Funding in a Web3 Economy

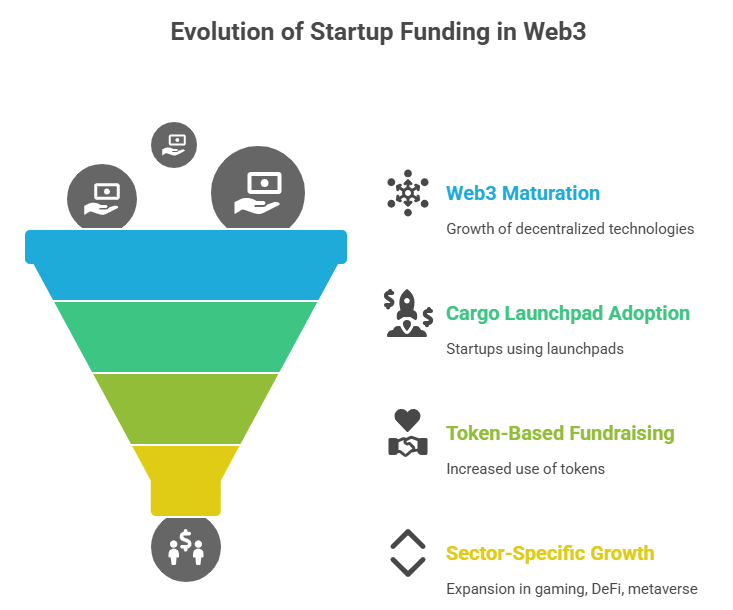

Cargo launchpads will become a reality as Web3 matures and startups turn to the tool. They fit exactly the ideals of decentralization best: reducing barriers, democratizing access, and linking founders with global capital. Engineering projects that are ahead of their time may in the future use launchpads as the default gateway to funding the projects between the idea and the means to bring it to fruition.

Analysts assume that by 2025 token-based fundraising will constitute a large share of startup funds, particularly within such sectors as gaming, DeFi, and metaverse applications. In the case of entrepreneurs, it is not a choice to adjust to this change but is increasingly becoming a necessity to remain competitive.

Conclusion

One of the most difficult things startups have ever faced is raising capital. Old-fashioned fund-raising usually takes months and requires trade-offs that decelerate innovation. Cryptocurrency launchpads alter that formula. The combination of speed, transparency and community-finance makes them potentially the best way to finance start ups with resources fast as early adoption picks up.

The facts speak volumes: multi-million-dollar token sales to the emergence of entire gaming and DeFi ecosystems have all been fueled by launchpads as a means to grow and grow quicker. However, speed is not all that is needed to achieve long-term success, the balance between rapid fundraising and adherence to the regulations, trust-building, and long-term tokenomics should be the key to success. Those startups which are able to strike this balance will determine the future of Web3 and further.

In Gyan consulting, we help startups to go through all of this. We have pioneered the creation of compliant token models and the development of launchpad-ready platforms so that founders can raise capital more quickly, without losing credibility or vision.

With a deep passion for technology and enterprise growth, I help organizations embrace AI development, blockchain solutions, and custom software to drive lasting transformation. As Senior Business Development Manager at Gyan Consulting, I combine strategic insight with hands-on industry knowledge, enabling businesses to scale smarter and innovate with confidence. View Profile